Parents have a legal obligation to support their children financially. As such, family courts in Arizona often order that one parent must pay child support to the other parent, usually the child’s primary caretaker.

Child support payment amounts are determined on a case-by-case basis – however, there is a general set of guidelines used by the courts to help calculate a fair amount.

Process of determining the cost of child support

There are two ways that child support payment amounts may be decided in Arizona: by a settlement between the parents or by the court.

If the parents can agree

During the divorce process, parents may decide the terms of their divorce, including the amount of child support, without court intervention. If both parties agree on an amount, they may draft a settlement agreement that includes the agreed-upon child support amount and submit it to the court for final approval.

An agreed-upon support order isn’t required to adhere to the state guidelines, and the parents are free to negotiate a mutually agreeable figure as long as it meets the child’s needs.

If the parents cannot agree

In cases where parents can’t agree on an amount, the court will likely issue a ruling based on the state’s Child Support Guidelines using a computer program that automatically calculates a figure based on various points and inputs of data. However, the judge isn’t required to adhere strictly to this calculation and may make adjustments based on the particular circumstances of a case if a deviation is in the child’s best interests.

A court-ordered child support amount could be higher or slightly lower than the calculation suggests if it still meets the state guidelines.

Arizona Child Support Guidelines

The Arizona family court system aims to have each parent contribute to their child’s financial needs in a way that’s proportionate to the share of income each parent earns. For that reason, the Arizona Child Support Guidelines consider both parents’ incomes when determining child support amounts.

Calculating incomes

The court begins by assigning a figure called Child Support Income, rather than gross income, to each parent. This is the income earned by the parent from any source before deductions or withholdings, which may include:

- Salaries and wages

- Commissions and bonuses

- Capital gains

- Disability benefits

And more

This means that “income” for child support purposes isn’t limited to what’s reported on tax returns, especially for self-employed parents.

Sometimes, the court may attribute income to a parent who is unemployed or underemployed but capable of working full-time. The court may set an amount based on state and local labor market statistics as well as individual factors such as the parent’s job skills, educational background, and health status. This ensures that the child support amount accurately reflects the earning potential of each parent and is fair to both parties.

Adjustments may also be made when a parent currently has other child support obligations or pays spousal maintenance.

Arriving at a child support obligation amount

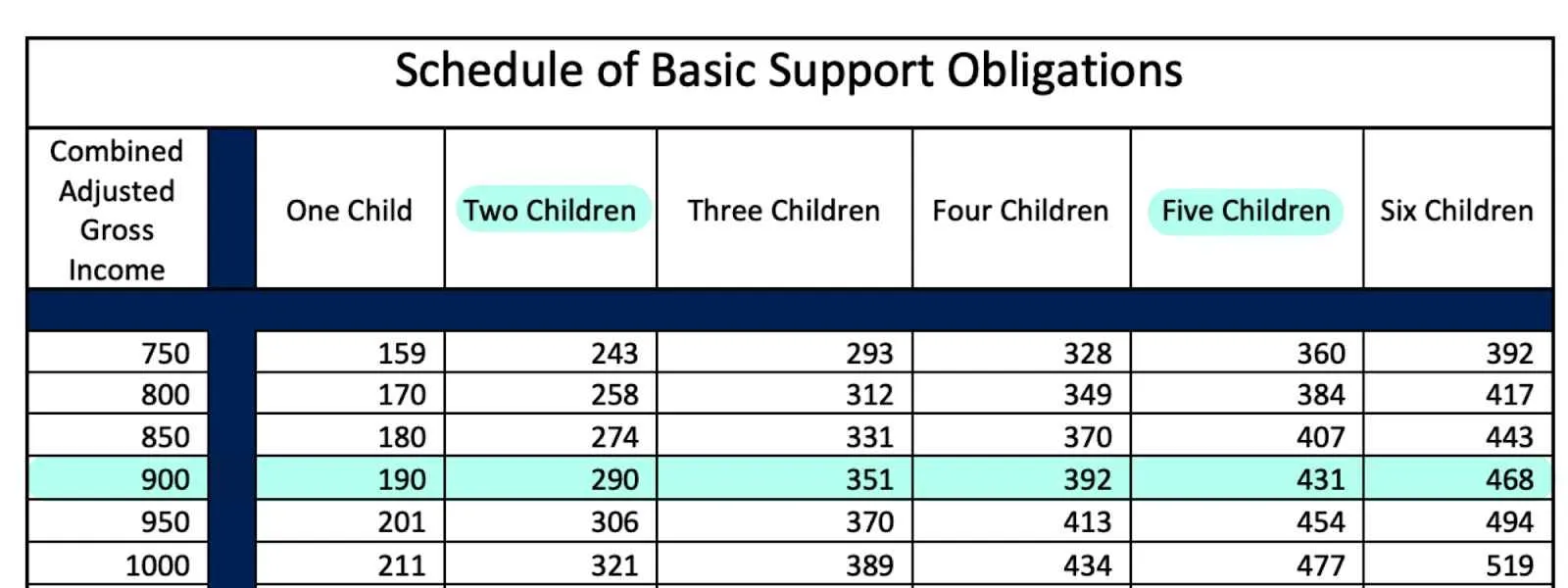

After the court calculates a Child Support Income amount for each parent, it combines these figures into a Combined Adjusted Child Support Income. Using the Schedule of Basic Support Obligations table, the court compares that amount to the number of children involved.

Possible adjustments

This suggests the basic amount of child support payments for the family. However, there may be adjustments to this amount based on factors such as children aged 12 or older, medical insurance coverage for the child, childcare, and education expenses, and costs to support a child with special needs.

Adjustment for parenting time

The court then arrives at a Combined Child Support Obligation amount and divides it between both parents proportionally to their Child Support Incomes.

Further adjustments may be made to account for costs associated with the amount of parenting time each parent has been assigned. Parents with a higher parenting time typically have their child support obligations reduced accordingly. Once this factor is accounted for, the court can issue its final ruling on the amount of child support the paying parent must provide.

For example, here’s a small section of the Schedule of Basic Support Obligations. If the parents’ Combined Adjusted Gross Income is $900 and they have two children, then the amount of child support owed is $290. Likewise, if they had five children, $431 would be owed in child support.

An attorney can help you navigate your child support matter

There are many nuances to the Arizona Child Support Guidelines, and a qualified attorney at Blanchette Law PLLC can help you understand how they apply to your case. If you need further support, our Tempe child support lawyer can represent your interests in court or settlement negotiations and help you secure an outcome that’s fair for everyone involved. Contact Mrs. Blanchette today at (602) 881-1748 to get started.